Costa Rica tax outlook

Costa Rica Country Guide

Everything you need to know about moving to Costa Rica

Tax outlook for expats moving to Costa Rica

Learn how to take advantage of deductions and exclusions to minimize your tax bill

Costa Rica does not tax foreign-source income, which can be beneficial for retirees and remote workers. Expats should also be aware of property taxes, capital gains taxes, and the country’s value-added tax (VAT) system, as well as various exclusions and deductions in order to minimize your tax burden.

Navigate page

Income Tax for Expats in Costa Rica

Costa Rica’s income tax system focuses on earnings generated within its borders. If your income primarily comes from sources like Social Security, pensions, real estate investments in your home country, online business activities, or freelance work, you are typically exempt from income tax in Costa Rica. It’s important to note that the Costa Rican tax year spans from October 1 to September 30.

However, any income generated within Costa Rica itself, whether from employment, running a business, or income from vacation rentals, is subject to Costa Rican taxation. The tax rate follows a progressive structure, with different tax brackets applying to salary and wages as well as other income-generating endeavors, including self-employment. Additionally, tax on dividend and interest income is typically levied at a rate of 15%.

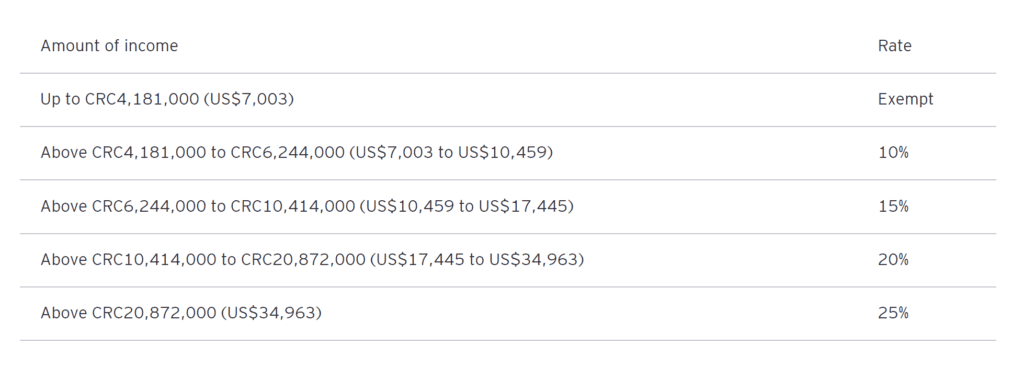

Tax Brackets in Costa Rica

The following table represents the income tax bracket for 2023:

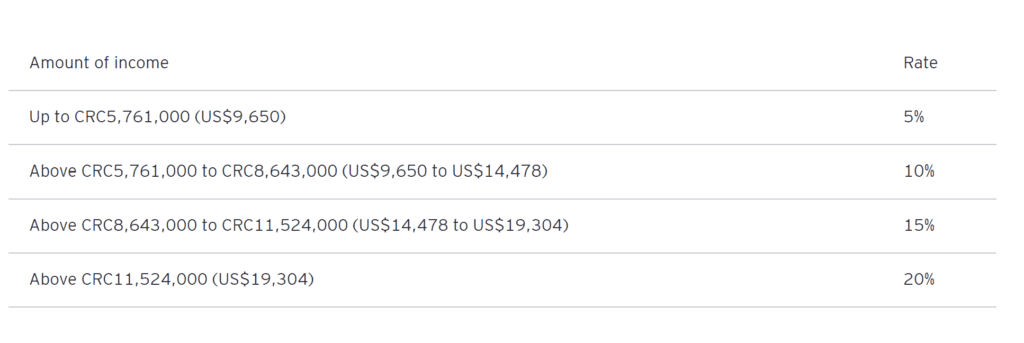

The following table demonstrates the 2023 corporate tax rate in Costa Rica:

Sales Tax in Costa Rica

In Costa Rica, sales tax rate, which is equivalent to Value Added Tax (VAT), is set at 13%. This tax covers most goods, although certain exceptions include foodstuffs, medicinal products, and specific items.

Property and Inheritance Tax in Costa Rica

Property tax in Costa Rica

Property taxes in Costa Rica are notably more affordable than those in North America. In Costa Rica, the annual property tax rate is a consistent 0.25% of the property’s assessed tax value at the local Municipality. Additional nominal charges may apply for various municipal services, including waste collection and road maintenance.

Property owners have flexibility in tax payment options. They can opt to make the annual payment in January, with some municipalities offering discounts for full upfront payments. Alternatively, property taxes can be conveniently paid in quarterly installments, with due dates in March, June, September, and December.

For properties with values above CRC 137 million (roughly $260,000.000 USD) you may also have to pay a luxury tax of 0.25-0.55%.

Inheritance tax in Costa Rica

Expats are able to inherit property or assets owned by their partners or parents in Costa Rica. Inheritance and gifts are not taxed in Costa Rica, however a progressive tax (see table) is applied to the transfer of properties and property rights.

However, if a property is owned by a corporation, and 50% of that company’s shares are transferred to heirs or beneficiaries, particularly in the event of the original owner’s passing, a tax equal to 1.5% of the real estate’s value becomes applicable.

Foreign Earned Income Exclusion for U.S. Expats in Costa Rica

The United States requires all of its citizens to file taxes, including expats. However, there are substantial exclusions available to ease the tax burden for expatriates. The most accessible of these is the Foreign Earned Income Exclusion.

For the tax year 2023, expats can exclude the initial $120,000 of foreign earned income from their U.S. tax obligations, provided they meet the eligibility criteria.

There are two ways that an individual can qualify for the FEIE:

- The Physical Presence test requires that the individual has spent 330 out of the previous 365-day period outside of the US (this is not limited to Costa Rica).

- The Bona Fide Resident test requires that an individual demonstrate that they have legal residency in a foreign country.

It’s important to note that Social Security income is not considered as foreign earned income for this exclusion.

Foreign Housing Deduction for U.S. Expats in Costa Rica

U.S. expatriates who claim the Foreign Earned Income Exclusion (FEIE) and find their income exceeding the established FEIE threshold have the opportunity to apply this exclusion to eligible expenses. These expenses encompass items such as rent, parking, furniture rental, utilities, and more, allowing them to be excluded or deducted from their tax obligations. In the tax year 2023, American expats have the potential to exclude or deduct up to $19,200 in eligible expenses, providing a valuable opportunity for tax savings.

Foreign Tax Credit for U.S. Expats in Costa Rica

The Foreign tax credit system allows you to offset taxes you paid in Costa Rica for your US expat taxes (or vice versa) dollar for dollar. Note that you can’t use the credit on income that has already been excluded by the Foreign Earned Income Exclusion.

Additional Tax Reporting Requirements for U.S. Expats in Costa Rica

Depending on your financial holdings in Costa Rica, you may have additional reporting requirements.

FBAR Reporting: U.S. citizens with foreign bank accounts exceeding a cumulative value of $10,000 at any point during the year are required to file an FBAR (Report of Foreign Bank and Financial Accounts).

Form 8938 (FATCA): Expats with foreign accounts and assets, including stocks, bonds, real estate, and insurance, must file Form 8938 (Foreign Account Tax Compliance Act). For single filers, the threshold is assets worth $200,000 at the end of the year or combined assets exceeding $300,000 at any time during the year. For couples, the limits are $400,000 on the last day of the year or combined assets over $600,000 at any time during the year.

Penalties for foregoing these additional filings can be steep.

Want to speak with an expert?

Speak with an international relocation specialist for free

Costa Rica client reviews

Clay & Sarah (& Sam)

Costa Rica Concierge

Clients

We would highly recommend using StartAbroad for your relocation needs… [Their relocation] program is very comprehensive and they anticipated our every needs to make sure that our move went smoothly.

We would have made many mistakes on our own… [StartAbroad was] worth every penny and now looking back we can’t imagine having made this move without their assistance.

Reggie W.

Costa Rica Concierge Client

It was an ultimate pleasure working with StartAboard, from start to finish they took care of every minor detail. Their service took loads of pressure off my hands as you can imagine all the small details and variables you have to consider when moving to a different country.

I would highly recommend StartAboard if you are looking to relocate.

Mateo

Digital Nomad Visa Support

[The team at] StartAbroad were absolutely fantastic… These guys saved our family so much time – it’s quite difficult to quantify the value of their service. One thing for sure, for the small amount that they charged us for facilitating our digital nomad visas – in comparison to the huge amount of time we saved, is substantial!

Very pleasant to work with, very professional, clearly they care very much about what they are doing and their work reflects this.

Join our mailing list

Receive monthly newsletters, special offers, insider information, and more.