Home

Relocate Internationally With Complete Confidence

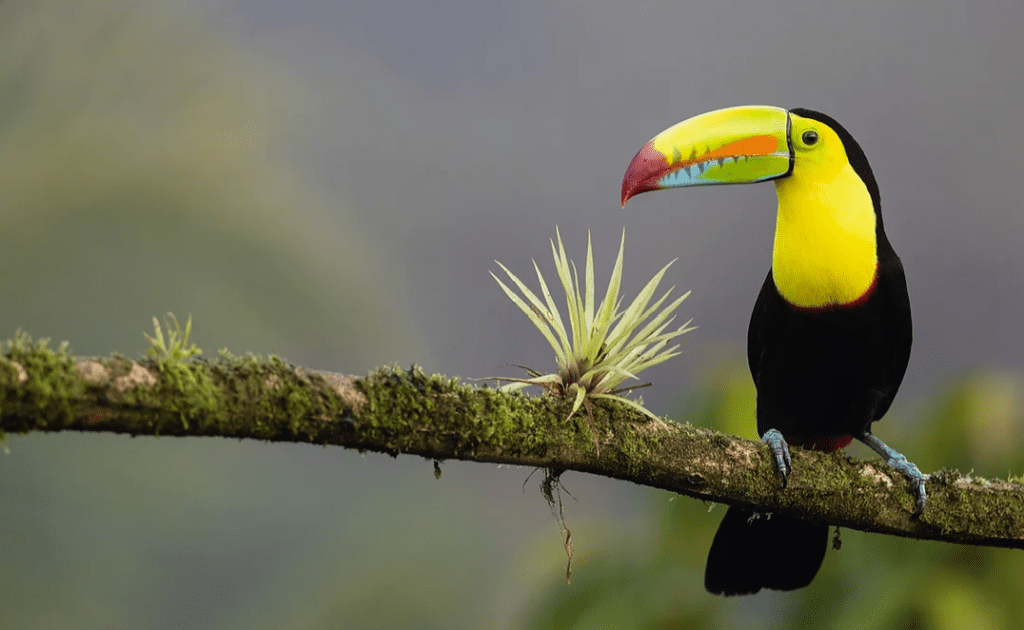

Supporting relocations to:

Not sure where is right for you? Take our quiz

It can be hard to pick between the many wonderful destinations where you could live. Take StartAbroad’s “What Country Should I Move To?” quiz to see where might be right for you.

Why Work with StartAbroad?

We make two promises to our clients:

1. We’ll save you significant amounts of time, money, and stress

2. We’ll be in your corner, every step of the way

Save time

Many people sink hundreds — sometimes thousands — of hours into their relocation. When StartAbroad manages your move, you get all of your time back.

Save money

Avoid expensive pitfalls & mistakes by taking advantage of StartAbroad’s best-in-class partner network and deep relocation experience.

Save hassle

Moving abroad is stressful! Let StartAbroad handle the logistics of your move so that your dream move is a dream.

StartAbroad has been featured in:

Who We Work With

No two moves are the same. At StartAbroad, we know that there is no one-size-fits-all solution. That’s why we provide on the ground support, tailored to you.

Our Services

StartAbroad client reviews

We would highly recommend using StartAbroad for your relocation needs… [Their relocation] program is very comprehensive and they anticipated our every needs to make sure that our move went smoothly.

We would have made many mistakes on our own… [StartAbroad was] worth every penny and now looking back we can’t imagine having made this move without their assistance.

Clay & Sarah (& Sam)

Costa Rica Concierge Clients

My work schedule doesn’t leave me much time to plan effectively and that’s why I’m glad I found… StartAbroad. From the first call with Anna, I knew she really listened to me and what I needed based on the questions she asked. By the time we had our next conversation, she had prepared my entire list of tasks and topics with timelines.

I know that some people will do this on their own and that’s great. But for me, this is money well spent and it gives me peace of mind.

Lorraine

Portugal Concierge Client

It was an ultimate pleasure working with StartAboard, from start to finish they took care of every minor detail. Their service took loads of pressure off my hands as you can imagine all the small details and variables you have to consider when moving to a different country.

I would highly recommend StartAboard if you are looking to relocate.

Reggie W.

Costa Rica Concierge Client

As a concierge client StartAbroad handled every necessary detail for a successful purchase of property in Portugal and pathway to the Golden Visa. I am on my way!

Time was everything for me and the concierge fee was well worth the price and in fact was a “steal” given that they handled every detail from property assessment, all in-country expertise including buyer’s realtors, specialist attorneys, hotels, car rentals etc.

Elias

Portugal Concierge Client

[The team at] StartAbroad were absolutely fantastic… These guys saved our family so much time – it’s quite difficult to quantify the value of their service. One thing for sure, for the small amount that they charged us for facilitating our digital nomad visas – in comparison to the huge amount of time we saved, is substantial!

Very pleasant to work with, very professional, clearly they care very much about what they are doing and their work reflects this.

Mateo

Digital Nomad Visa Support

Join Our Mailing List

Receive monthly newsletters, special offers, insider information, and more.