Portugal tax outlook

Portugal Country Guide

Everything you need to know about moving to Portugal

Tax outlook for expats moving to Portugal

Learn how to take advantage of deductions and exclusions to minimize your tax bill

When moving to Portugal or any other foreign country, you need to be aware of two things related to your tax situation:

How living abroad will impact your home country tax requirements, and

What your tax filing requirements will be in the foreign country you are moving to.

Navigate page

Income Tax for Expats in Portugal

Generally speaking, expats are taxed in Portugal based on residency:

Portuguese residents (those who spend 183 days+ in Portugal over a 12 month period or maintain an abode) are taxed on worldwide income

Non-residents are only taxed on Portugal-sourced income

An “abode” is a domestic residence (purchased or rented) that you intend to keep and occupy habitually.

Once you establish residency in Portugal, you need to be aware of Portuguese tax rates and will be obligated to file tax in Portugal, even if you do not owe any money to the government.

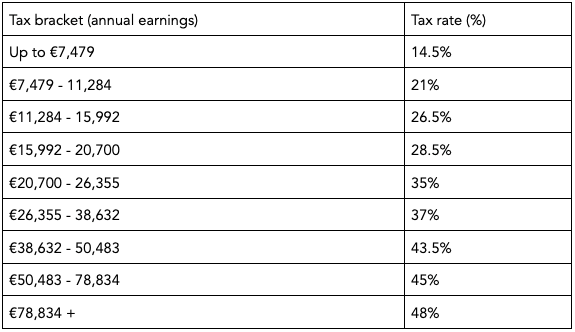

Tax Brackets in Portugal

The following table represents personal income tax brackets for 2023:

Tax rates in 2024 are likely to decrease slightly following the passage of the 2024 budgetary bill.

NHR and Tax Regimes in Portugal

Portugal has a progressive tax system that taxes residents at higher rates than North Americans may be used to (see tables above). Through 2023, new residents could benefit from the non-habitual residency (NHR) scheme. NHR gives newcomers different tax rates on certain types of income for 10 years.

Unfortunately, the Portuguese government has taken steps to minimize or eliminate NHR as of the end of 2023. Alternative tax incentives may come into play as the NHR disappears.

Tax under the NHR regime:

most foreign income is tax-exempt

no wealth tax

10% tax on pensions (as of 2022)

no tax on gifts or inheritance to direct family

20% income tax for entrepreneurs and “high value” professionals working in Portugal

Portugal Tax Treaties

The USA and Canada each have a tax treaty in place with Portugal that prevents double taxation of US/Canadian citizens residing in Portugal.

The United States still requires all citizens to file tax returns, although the amount of tax you must pay is likely to be greatly reduced if you are residing outside of the US. Canadian citizens do not have to file taxes in Canada once they are determined to be non-residents of Canada.

Foreign Earned Income Exclusion for U.S. Expats in Portugal

The United States requires all of its citizens to file taxes, including expats. However, there are substantial exclusions available to ease the tax burden for expatriates. The most accessible of these is the Foreign Earned Income Exclusion.

For the tax year 2023, expats can exclude the initial $120,000 of foreign earned income from their U.S. tax obligations, provided they meet the eligibility criteria.

There are two ways that an individual can qualify for the FEIE:

- The Physical Presence test requires that the individual has spent 330 out of the previous 365-day period outside of the US (this is not limited to Costa Rica).

- The Bona Fide Resident test requires that an individual demonstrate that they have legal residency in a foreign country.

It’s important to note that Social Security income is not considered as foreign earned income for this exclusion.

Foreign Housing Deduction for U.S. Expats in Portugal

U.S. expatriates who claim the Foreign Earned Income Exclusion (FEIE) and find their income exceeding the established FEIE threshold have the opportunity to apply for the Foreign Housing Deduction or Exclusion.

This exclusion or deduction can cover expenses such as rent, parking, furniture rental, utilities, and more. In the tax year 2023, American expats have the potential to exclude or deduct up to $19,200 in eligible expenses, providing a valuable opportunity for tax savings.

Foreign Tax Credit for U.S. Expats in Portugal

The Foreign tax credit system allows you to offset taxes you paid in Portugal for your US expat taxes (or vice versa) dollar for dollar. Note that you can’t use the credit on income that has already been excluded by the Foreign Earned Income Exclusion.

Additional Tax Reporting Requirements for U.S. Expats in Portugal

Depending on your financial holdings in Portugal, you may have additional reporting requirements.

FBAR Reporting: U.S. citizens with foreign bank accounts exceeding a cumulative value of $10,000 at any point during the year are required to file an FBAR (Report of Foreign Bank and Financial Accounts).

Form 8938 (FATCA): Expats with foreign accounts and assets, including stocks, bonds, real estate, and insurance, must file Form 8938 (Foreign Account Tax Compliance Act). For single filers, the threshold is assets worth $200,000 at the end of the year or combined assets exceeding $300,000 at any time during the year. For couples, the limits are $400,000 on the last day of the year or combined assets over $600,000 at any time during the year.

Penalties for foregoing these additional filings can be steep, so it makes sense to consult with a tax expert if you think you might need to file in the upcoming year.

Want to speak with an expert?

Speak with an international relocation specialist for free

Helpful resources

Partner Article: Protect Yourself From Currency Volatility When Purchasing a Property in Portugal

Portugal client reviews

StartAbroad made the process easy and manageable. Anna is the BEST, she informed me of the necessary steps to get me to Portugal. StartAbroad helped with housing, needed documents, and the million questions I had. I highly recommend their services if you want an easy and very manageable process to travel and live overseas.

Joyce L.

Portugal Concierge Client

Richard F.

Rental Search Client

We greatly appreciated the personable…concierge service that StartAbroad offered. [They] listened to what we said and what we did not say and helped us plan a very fun, but strategic exploratory trip. We were able to see multiple cities during our very brief visit and have a lot of fun along the way.

Tea N.

Exploratory Trip Client

Join our mailing list

Receive monthly newsletters, special offers, insider information, and more.